Unit 8 - The State of Fiat Currency

Learning Objective: Assess the state of fiat currency, including its relationship to debt, government borrowing, inflation, and economic stability.

Unit Outline

8.1 The State of Fiat Currency

8.2 The U.S. Treasury

8.3 The The Budget Deficit and the National Debt

8.4 U.S. Debt Clock

8.5 Perpetrators of Fiscal Malfeasance

8.6 Fiscal Policy

8.7 Government Borrowing

8.8 The Cost of Government Borrowing

8.9 Selling Bonds

8.10 Taxation without Representation

8.11 Bondholders

8.12 Deficit Spending – Where Does All the Money Go?

8.13 Defense Spending

8.1 The State of Fiat Currency

Fiat currency, unlike commodity-backed money, relies entirely on government credibility and the ability to enforce its acceptance through legal tender laws. Without a physical commodity like gold or silver backing it, fiat currency can be produced indefinitely—a power often abused.

Key Observations:

- Fiat currency allows unlimited borrowing and spending, creating systemic risks.

- The U.S. has run consistent deficits since 2001 and is now $33+ trillion in debt.

Future generations are saddled with this burden through inflation and taxation.

8.2 The U.S. Treasury

The U.S. Treasury is responsible for:

- Collecting taxes through the Internal Revenue Service.

- Issuing debt in the form of Treasury securities.

- Paying bills for government operations.

- Managing public debt.

Key Facts:

- Established in 1789; Alexander Hamilton was its first Secretary.

- Janet Yellen, the current Secretary, previously chaired the Federal Reserve—highlighting the interconnectedness between monetary (Federal Reserve) and fiscal (Treasury) policy.

Reality Check:

Despite its name, the Treasury has no surplus funds. The last budget surplus occurred in 2001.

8.3 The Budget Deficit and the National Debt

8.3.1 The Budget Deficit

A budget deficit occurs when government spending exceeds revenue in a given year. To fund this shortfall, the Treasury borrows money by issuing bonds and other securities.

Example:

FY 2024 Deficit = $1.83 trillion

8.3.1 The Budget Deficit

8.3.2 The National Debt

The national debt is the total accumulated deficits plus interest owed.

Analogy:

The federal government operates like a credit card user who:

- Spends more than they earn.

- Pays only the minimum payment.

- Borrows more to cover the shortfall—creating a debt spiral.

Current Debt (2024): Over $35.46 trillion.

8.4 U.S. Debt Clock

For real-time debt data, visit: www.usdebtclock.org

Key Figures to Observe:

- Debt per Citizen: Over $98,000.

- Debt per Taxpayer: Over $258,000.

- 2027 Projection: Use the “Debt Clock Time Machine” feature.

Reflection:

Can this trajectory continue without economic or social upheaval?

8.5 Perpetrators of Fiscal Malfeasance

Who is responsible for the sad state of Federal finances?

- The Executive Branch: The Treasury is under the Executive Branch. The President proposes an annual budget that includes revenue and expense targets.

- Congress: Approves budgets and controls taxation.

Despite constitutional checks and balances, both branches perpetuate deficit spending, often prioritizing short-term political gains over long-term fiscal stability.

8.6 Fiscal Policy

Definition: The use of government spending and tax policies to influence economic conditions, especially macroeconomic conditions.

Modern U.S. fiscal policy is rooted in Keynesian economics:

- Government spending is used to stimulate demand during downturns.

- Deficit spending is justified as a means to avoid recessions.

Criticism:

While effective short-term, Keynesian policies often create long-term debt and dependence on government intervention.

8.7 Government Borrowing

Since the Treasury lacks reserves, the government borrows money by issuing Treasury Bonds.

T-Bonds Basics:

- Maturity: 20–30 years.

- Interest Payments: Paid semiannually.

Considered safe because they are backed by the government’s ability to tax citizens.

8.8 The Cost of Government Borrowing

Example:

- $1,000 bond at 5% interest for 30 years.

- Annual interest = $50.

- Total cost = $2,500 (including repayment of principal).

Observation:

Interest payments grow exponentially, consuming larger shares of the federal budget.

8.9 Selling Bonds

The Treasury sells bonds through primary dealers (large Wall Street banks) to investors, including:

- Foreign governments.

- Pension funds.

- Insurance companies.

The flow diagram below shows how bonds (IOUs) flow from the Treasury to investors and how fiat dollars flow from investors into the coffers at the Treasury:

8.10 Taxation without Representation

Future generations inherit unsustainable debt without a vote—effectively taxation without representation.

Historical Context:

The phrase “taxation without representation” originates from the American Revolution, where colonists protested being taxed by the British Parliament without having elected representatives. It symbolized a violation of democratic principles, sparking demands for self-governance.

Today, deficit spending and debt accumulation impose similar burdens on future generations—burdens they have no ability to vote against, challenge, or influence.

Ethical Considerations:

- Intergenerational Theft: Governments borrow heavily to fund current spending, leaving repayment—and the consequences of inflation and higher taxes—to future taxpayers.

- Moral Hazard: Elected officials face little accountability for long-term fiscal mismanagement, prioritizing short-term political gain over sustainable policies.

- Consent and Fairness: Future generations cannot consent to the obligations being placed upon them, violating principles of fairness and democratic representation.

Practical Implications:

- Debt Dependency: Interest payments on national debt divert resources from essential services like infrastructure, education, and healthcare.

- Economic Instability: Rising debt levels increase vulnerability to inflation, currency devaluation, and systemic financial crises.

- Reduced Opportunity: Younger generations face fewer economic opportunities due to slower growth and higher tax burdens to service existing debt.

Modern Examples:

- United States: The U.S. national debt exceeded $34 trillion in 2024, with interest payments alone reaching hundreds of billions annually.

- Greece: Faced economic collapse and austerity measures due to unsustainable borrowing, forcing severe cuts to public services and pensions.

Key Takeaway:

The growing debt burden imposed on future generations mirrors the injustice that sparked the American Revolution. Without reforms, this practice perpetuates economic inequality, undermines democratic principles, and leaves the next generation to clean up the mess of irresponsible fiscal policies.

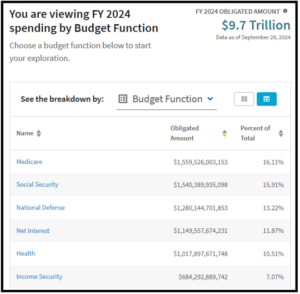

8.12 Deficit Spending – Where Does All the Money Go?

Budget Breakdown (2024):

- 50%: Social programs (Medicare, Medicaid, Social Security).

- 13%: Defense spending.

- 11.8%: Interest on the debt.

Concern:

Interest payments are the fastest-growing expense, crowding out spending on infrastructure, education, and health care.

https://fred.stlouisfed.org/series/A091RC1Q027SBEA

8.12.1 Mandatory verus Discretionary Spending

“The federal spending is split into two categories: discretionary and mandatory. Mandatory spending does not require action every year, while discretionary spending does.”

Congress doesn’t need to pass new laws each year for mandatory spending programs like Medicare and Social Security to operate; they continue automatically unless Congress changes the law. Sometimes, changes occur because Congress sets a timeline for modifications.”

“The federal government spent $6.2 trillion in fiscal year 2023 — $3.8 trillion of mandatory spending (~60%), $1.7 trillion of discretionary spending, and $659 billion in interest on outstanding US debt.” See https://usafacts.org/articles/how-much-of-the-federal-budget-is-mandatory-spending/

“Discretionary spending is split into defense and nondefense spending. Defense spending is the largest single category of discretionary spending, totaling $806 billion in fiscal year 2023.” See https://usafacts.org/articles/how-much-of-the-federal-budget-is-discretionary-spending/

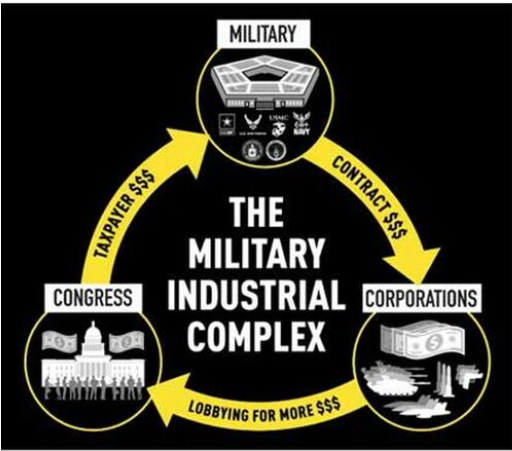

8.13 Defense Spending

The U.S. spends more on national defense/warfare than the next 9 countries combined:

In 1961, during his farewell address, President Dwight D. Eisenhower warned American citizens about the “military-industrial complex”:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. The potential for the disastrous rise of misplaced power exists, and will persist.”

“This conjunction of an immense military establishment and a large arms industry is new in the American experience. . . .Yet we must not fail to comprehend its grave implications.”

“Until the latest of our world conflicts, the United States had no armaments industry. American makers of ploughshares could, with time and as required, make swords as well. But we can no longer risk emergency improvisation of national defense; we have been compelled to create a permanent armaments industry of vast proportions.” https://www.archives.gov/milestone-documents/president-dwight-d-eisenhowers-farewell-address

Conclusion:

The state of fiat currency in the United States reveals both its power and its fragility. While the ability to create money “out of thin air” has enabled economic expansion, social programs, and crisis management, it has also led to massive deficits, unsustainable debt, and economic inequality.

Fiat currency has allowed the U.S. government to fund expensive “bread and circus” programs—social welfare and entitlement spending designed to appease the public—alongside record-high military budgets to project global dominance and enforce the dollar’s reserve currency status. This combination of domestic appeasement and international hegemony has created an economic model that depends on continuous borrowing and deficit spending.

Military Spending:

The United States spends more on defense than the next 9 nations combined, maintaining a global military presence to defend its economic and financial interests. Much of this spending supports the petrodollar system and ensures global demand for dollars, reinforcing its position as the world’s reserve currency.

Bread and Circus:

Domestically, fiat currency has funded expansive social programs, healthcare, and subsidies to sustain public satisfaction. However, these programs have created dependency and ever-growing obligations, while the rising national debt threatens their long-term viability.

Key Takeaway:

Fiat currency has enabled government spending on military dominance and domestic entitlements, but this strategy is inherently unsustainable. Without fiscal discipline or structural reforms, the combination of endless deficits, debt dependency, and inflation risks eroding public trust and financial stability, pushing the system closer to collapse.