Lesson 11 - The Morality of Money

Learning Objective: Understand and be able to explain the difference between moral money and immoral fiat currency, and analyze the ethical implications of modern monetary policies and free money schemes.

Lesson Outline

11.1 The Morality of Money

11.2 The Law of the Harvest versus Getting Something for Nothing

11.3 Fiat Currency: The Government Getting Something for Nothing

11.4 Usury: The Business of Getting Something for Nothing

11.5 Gambling and Lotteries: The Consumer Getting Something for Nothing

11.6 Good Money vs. Bad Money: Gresham’s Law vs. Thiers’ Law

11.7 Moral Hazard: Rewarding Bad Behavior

11.8 Modern-Day Slavery and Debt Dependency

11.9 Bondholders and Sovereign Debt

11.10 Modern Monetary Theory (MMT): Free Money Fantasy or Path to Enslavement?

11.11 Universal Basic Income (UBI): Dependency Disguised as Security

11.12 The Role of Commodities in Moral Monetary Systems

11.13 The Ethics of Inflation: Hidden Taxation and Wealth Redistribution

11.14 The Truth About Money

11.1 The Morality of Money

Morality concerns right and wrong behavior. Money, defined as anything requiring work to produce, is inherently moral when obtained legally and through effort. Conversely, fiat currency—created without work—is immoral because it represents “something for nothing,” violating the natural law that value must be earned.

Throughout history, economic thinkers and moral philosophers have argued that a society built on moral principles cannot sustain itself if its monetary system is inherently immoral. The disconnect between ethical values and monetary practices, such as creating wealth without work through fiat currency, has often led to economic instability, social inequality, and the erosion of trust in institutions.

This raises an important question: Can a society remain free, fair, and just if its financial system is built on deception?

11.2 The Law of the Harvest vs. Getting Something for Nothing

The law of the harvest teaches that you reap/harvest what you sow/plant—highlighting the relationship between effort, work, and reward. Economic prosperity depends on fairness, responsibility, and the principle that value is created through labor and productivity. Systems that promote getting something for nothing—whether through theft, fiat currency creation, or manipulation—undermine these virtues and erode trust, stability, and long-term prosperity.

11.3 Fiat Currency: The Government Getting Something for Nothing

Fiat currency—money created without labor—is inherently immoral because it allows governments to get “something for nothing.” History shows that what governments often seek is domination, and domination requires war—funded by monetary debasement. With the power to create unlimited money, fiat currency can also finance unlimited war. Worse still, defending an immoral fiat currency regime often leads to even more wars to preserve its dominance. Look around—are we not in a perpetual state of war? In the end, no one truly wins in war—everyone loses. Killing people to sustain an immoral monetary system is, by association, immoral.

11.4 Usury: The Business of Getting Something for Nothing

Historically, usury—charging excessive interest on loans—was condemned as immoral. Both Christian and Islamic teachings discouraged profiting from others’ misfortune, emphasizing kindness and generosity instead.

Modern Example: Payday Loans

Today, payday loan companies embody usury in its modern form. These lenders target low-income borrowers with short-term, high-interest loans, often trapping them in cycles of debt. Interest rates can exceed 400% APR, leaving borrowers unable to repay and forcing them to take out additional loans just to cover previous ones.

Key Principle:

Helping others in need should not be motivated by greed but by generosity and fairness. Modern usury, like payday lending, exploits financial hardship instead of alleviating it, highlighting the ongoing need for ethical reforms in lending practices.

11.5 Gambling and Lotteries: The Consumer Getting Something for Nothing

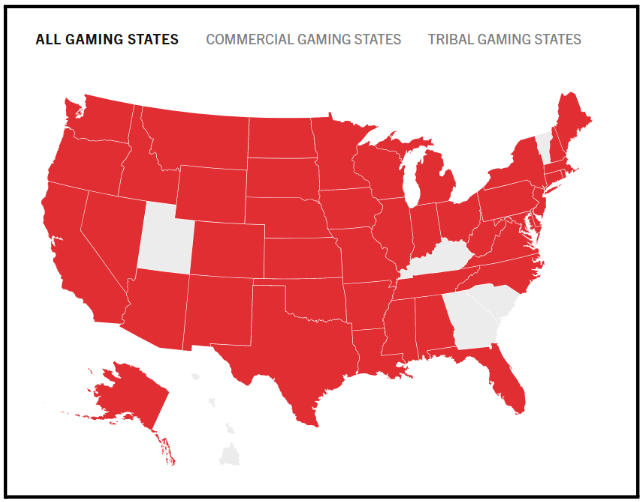

Gambling and lotteries prey on the human desire to get something for nothing. These activities, often discouraged by religious and moral teachings, undermine the virtues of work, thrift, and personal responsibility. While legal in most states, they disproportionately harm the poor, who are lured by false hope and often gamble away essential earnings. This creates a ripple effect of financial instability, unpaid debts, and broken families—costs that are ultimately borne by society through higher taxes, social programs, and charitable aid. Far from providing prosperity, gambling deepens poverty and shifts its consequences onto non-gamblers who must absorb the social and economic fallout.

States where gambling is legal:

https://www.americangaming.org/state-of-play/

11.6 Good Money vs. Bad Money: Gresham’s Law vs. Thiers’ Law

Gresham’s Law: “Bad money drives out good money.”

Example: When coins were debased (reduced in gold or silver content), people and businesses hoarded good coins and spent the bad ones, leading to inflation and instability.

Thiers’ Law (Opposite of Gresham’s Law): In the absence of legal tender laws, people and businesses reject bad money and demand good money.

Fiat currency exemplifies “bad money,” legally imposed and constantly devalued, contributing to widespread economic inequality.

Key Takeaway:

Legal tender laws force the use of fiat money (bad money), whereas free markets favor sound money backed by work and intrinsic value.

11.7 Moral Hazard

Government bailouts, like those during the 2008 financial crisis, create moral hazard by shielding corporations and banks from the consequences of risky behavior. Privatizing profits while socializing losses undermines free markets, encourages financial recklessness, and unfairly shifts the loss burden to taxpayers.

Moral hazard occurs when individuals or institutions are shielded from the consequences of their actions, encouraging risky behavior.

Example:

The 2008–2009 financial crisis saw governments bail out banks that made reckless loans, reinforcing irresponsible practices.

Key Takeaway:

Protecting bad actors undermines fairness and promotes instability. Free markets work best when participants bear the consequences of their actions.

11.8 Modern-Day Slavery and Debt Dependency

Debt is the modern form of slavery. Both individuals and nations fall into bondage through loans they cannot repay. Economic systems that encourage debt dependency erode freedom, as seen in exploitative lending practices described in John Perkins’ Confessions of an Economic Hitman. A just society must prioritize independence through responsible financial practices.

Proverbs 22:7 warns, “The borrower is slave to the lender.”

Excessive debt, both personal and national, creates dependency and control. Modern financial systems often enslave borrowers through loans and mortgages, making them beholden to creditors.

Nations trapped by debt face similar constraints, losing sovereignty to international lenders.

Key Takeaway:

Freedom depends on financial independence. Debt can be a tool for growth but becomes a form of enslavement when mismanaged.

11.9 Bondholders and the Consequences of Debt

The U.S. owes trillions to foreign bondholders like Japan and China. Will these debts be repaid honestly or inflated away through fiat creation? Either approach raises moral questions about fairness, trust, and integrity. Debt undermines sovereignty and places future generations in economic chains.

Key Takeaway:

Borrowing can lead to economic slavery, forcing nations to prioritize debt repayment over domestic needs.

11.10 Modern Monetary Theory (MMT): Free Money Fantasy or Path to Enslavement?

Modern Monetary Theory (MMT) argues that governments that control their own currency can never run out of money—they can always print more. Proponents claim this makes it possible to fund ambitious programs like universal healthcare, infrastructure, and debt forgiveness without worrying about deficits.

Key MMT Claims:

- Governments don’t need taxes to fund spending; they can simply print money.

- Inflation can be controlled through taxation or reducing spending later.

- Deficits are not a problem as long as they’re in the local currency.

Criticisms of MMT:

- Moral Hazard – Printing unlimited money rewards wastefulness and punishes savers by inflating away their purchasing power.

- Loss of Trust – Money backed by faith rather than work risks eroding trust in the financial system.

- Dependency and Control – Large-scale printing of money fosters dependency on government programs, reducing personal initiative and financial independence.

Key Takeaway:

MMT ignores the lessons of history. Nations that have debased their currencies—whether Rome’s denarius or modern examples like Zimbabwe—have collapsed under economic mismanagement. Promising “free money” undermines work, responsibility, and long-term economic stability.

11.11 Universal Basic Income (UBI): Dependency Disguised as Security

Universal Basic Income (UBI) proposes giving all citizens a set amount of money regularly, regardless of employment. Proponents argue it reduces poverty and provides security as automation eliminates jobs.

The Case for UBI:

- Provides a safety net for the unemployed.

- Simplifies welfare by eliminating complex social programs.

- Prepares societies for AI and automation-driven job losses.

The Case Against UBI:

- Dependency Instead of Productivity – Giving people money without requiring work erodes the work ethic and promotes laziness rather than initiative.

- Economic Unsustainability – Funding UBI requires higher taxes or more debt, exacerbating deficits and potentially leading to inflation.

- Loss of Freedom – UBI may come with strings attached, leading to government control over behavior and spending patterns.

- Erosion of Self-Worth – Work provides purpose and meaning. UBI risks creating a culture of dependency rather than empowerment.

Key Takeaway:

UBI’s promises mask its risks—dependency and loss of purpose. True security and self-fulfillment come from work and productivity, not handouts.

11.12 The Role of Commodities in Moral Monetary Systems

Commodities have historically been used as a moral form of money due to their intrinsic value and the work required to mine/farm and refine/produce them. Unlike fiat currencies, commodities cannot be created out of thin air, which enforces discipline and fairness.

Why Commodities Are Moral Money:

- Intrinsic Value – Commodities have inherent worth due to scarcity and utility.

- Work-Backed – Mining/farming and refining/producing commodities require labor, making it a form of stored work.

- Inflation Resistance – Commodities cannot be devalued easily, preserving purchasing power.

- Trustworthy – Unlike fiat currencies, commodities maintain value over time and cannot be inflated at will.

Key Takeaway:

Returning to commodity-backed money, like gold and silver, imposes discipline on governments and central banks, reducing opportunities for inflation and moral hazard.

11.13 The Ethics of Inflation: Hidden Taxation and Wealth Redistribution

Inflation, often called the “hidden tax,” reduces the purchasing power of money, silently transferring wealth from savers to borrowers and governments.

Ethical Concerns of Inflation:

- Wealth Redistribution – Inflation disproportionately impacts the poor and middle class, who hold their wealth in cash rather than assets like real estate or stocks.

- Deceptive Taxation – Unlike visible taxes, inflation reduces savings without voters’ explicit consent.

- Moral Hazard – Governments can inflate debt away instead of repaying it honestly, promoting irresponsibility and undermining fiscal discipline.

Historical and Modern Examples:

- Argentina (1980s–2020s) – Decades of inflation, including periods of hyperinflation, have destroyed savings, eroded wages, and created widespread poverty. Successive currency devaluations have led to social unrest and political instability.

- Zimbabwe (2000s) – Rampant hyperinflation saw prices double every 24 hours, leading to the collapse of the Zimbabwean dollar and the need to abandon it entirely in favor of foreign currencies.

- Venezuela (2016–2021) – Inflation exceeding 1,000,000% caused economic collapse, food shortages, and mass migration.

Key Takeaway:

Unchecked inflation is not just an economic issue—it’s a moral one. It acts as hidden taxation, distorts wealth distribution, and punishes savers while rewarding debtors. History shows that prolonged inflation erodes trust, destabilizes economies, and leaves lasting scars on societies. Responsible and moral monetary systems must protect citizens from such outcomes.

11.14 The Truth About Money

The modern monetary system thrives on deception—getting something for nothing through fiat currency and inflation. Recognizing this truth empowers individuals to demand fairness and advocate for sound monetary policies.

Fiat currency has enabled Americans to live beyond their means for decades, masking the inherent instability of a system based on “something for nothing.” As this illusion fades, understanding the truth about money becomes vital. Money, at its core, must represent work and value to sustain trust and fairness in society.

Conclusion: The Morality of Money

Money is more than a tool for transactions—it reflects the moral foundation of a society. Monetary systems based on work and fairness promote economic stability and human dignity. In contrast, fiat currencies, inflation, and free money schemes undermine discipline, reward irresponsibility, and foster dependency.

Key Takeaways:

- Moral Money Requires Work – Honest money requires effort to produce, reflecting fairness and value. Fiat currencies fail this test, enabling theft through inflation and manipulation.

- Dependency Destroys Freedom – Free money schemes like MMT and UBI erode self-reliance, replacing independence with reliance on the state.

- A Return to Discipline – Restoring commodity-backed systems or creating alternatives rooted in work can preserve fairness and freedom.

By understanding the morality of money, we can advocate for ethical financial systems that respect work, protect savings, and promote economic justice. Only through discipline and fairness can we sustain prosperity without sacrificing freedom.