Lesson 5 - The History of Money

Learning Objective: Understand, and be able to explain, the history of money and its transition from commodity money to representative money to fiat currency and the subsequent introduction of cryptocurrency.

Lesson Outline

5 The History of the Types of Money

5.1 The History of Money in America

5.1.1 Continental Currency

5.1.2 The Coinage Act of 1792

5.1.3 The Coinage Act of 1834

5.1.4 The Coinage Act of 1849

5.1.5 The Coinage Act of 1857

5.1.6 Greenbacks and The Legal Tender Act of 1862

5.1.7 The Coinage Act of 1873

5.1.8 The Gold Standard Act of 1900

5.1.9 The Federal Reserve Act (1913)

5.1.10 The Emergency Banking Act (1933)

5.1.11 Executive Order 6102 (1933)

5.1.12 Gold Reserve Act (1934)

5.1.13 WWII and The Bretton Woods Agreement (1944)

5.1.14 Bread, Circus, and War (1960’s)

5.1.16 Nixon Shock (August 15, 1971)

5.1.16 Petrodollar (1974 – Present (2015))

5.1.17 The Birth of Bitcoin (January 2009)

5 The History of the Types of Money

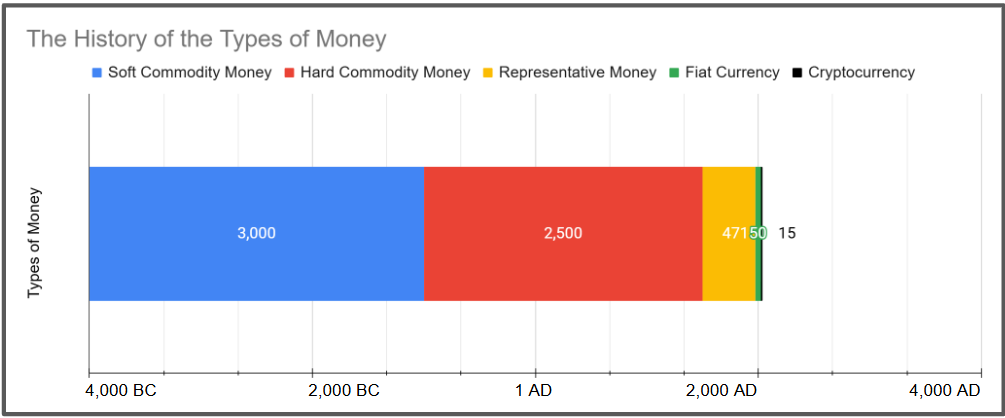

The history of money is intertwined with technological discoveries and human innovation. For thousands of years, money began as commodity money—things that had intrinsic value like grains, livestock, and metals. Over time, as societies advanced, so did their forms of money:

- 4000 BCE to 1000 BCE: Early forms of money included soft commodities like wheat, barley, and rice.

- 1000 BCE to 1500 CE: With the development of metallurgy, humans began using hard commodity money such as gold, silver, and bronze coins.

- 1500 CE to 1971 CE: The invention of the printing press by Johannes Gutenberg around 1440 allowed for the widespread use of representative money, like banknotes backed by gold or silver.

- 1971 to Present: In 1971, President Richard Nixon ended the U.S. dollar’s convertibility into gold, ushering in the era of fiat currency—money that is not backed by any physical commodity.

- 2009: The advent of cryptocurrency, with the creation of Bitcoin, introduced a new digital form of money that operates independently of government control.

The following chart shows the history of the types of money:

5.1 The History of Money in America

As you can imagine, money in colonial America was anything that had value. Money wasn’t as well defined, established, or regulated then as it is today. The most common types of money were specie/coin (hard commodity money), paper money/banknotes (representative money), or grains, tobacco, beaver skins, wampum, or other such commodity items (soft commodity money). Bartering with these items was commonplace.

5.1.1 Continental Currency

To fund the Revolutionary War, the Continental Congress authorized the printing of Continental currency, Continentals for short. Over a 5-year period (1775-1779), the Continental Congress issued $241,552,780 in Continental currency. Continentals were fiat currency with no commodity backing. They were essentially non-interest-bearing bonds. After being overissued, Continentals lost value quickly and became almost worthless, giving rise to the phrase, “not worth a Continental.”

5.1.2 The Coinage Act of 1792

With the defeat of the British in the Revolutionary War, early American leaders now focused on setting their financial house in order.

The Coinage Act of 1792 established the U.S. Dollar as the standard unit of money with the silver dollar at its core and at a value equal to that of the Spanish silver dollar. The Act specified that the U.S. dollar would contain 371 grains (or 24.1 grams) of pure silver.

The Act also established the US Mint in Philadelphia, Pennsylvania where citizens were able to bring gold and silver bullion and have it “coined” free of charge.

5.1.3 The Coinage Act of 1834

The Coinage Act of 1834 increased the silver-gold ratio from 15:1 as specified in the Coinage Act of 1792 to 16:1. As a result, one ounce of gold was equal to $20.67.

5.1.4 The Coinage Act of 1849 (Gold Coinage Act)

With the discovery of gold at Sutter’s Mill in Coloma, CA in 1848, the amount of gold bullion in the U.S. increased substantially. This Act authorized the minting of two new gold coins–the gold dollar ($1) and the double eagle ($20). In 1791, Alexander Hamilton had proposed both a $1 silver coin and a $1 gold coin but the gold dollar was not struck until 1849, likely due to limited quantities of gold available in the U.S. prior to the discovery of gold in ‘49. The Act formally introduced a bi-metallic dollar. It also defined the acceptable variations in quality/fineness for each type of gold coin.

5.1.5 The Coinage Act of 1857

The Coinage Act of 1857 removed the legal tender status of foreign-minted coins like the Spanish Dollar. Only coins minted by the U.S. Mint would be legal tender going forward. It was a step toward a more centralized and standardized national currency.

5.1.6 Greenbacks and The Legal Tender Act of 1862

To finance the Civil War, U.S. President Abraham Lincoln issued unbacked, fiat currency called greenbacks–named for the green-colored ink used on the back of the note.

This caused a bit of a stir as the citizens of the United States were generally reluctant to accept “paper money” (fiat currency). Perhaps in an effort to assuage the electorate, Lincoln reservedly remarked: “Silver and gold I have none, but such as I have I give to thee.”

California and Oregon were not amused and entirely refused to abide by the Act. This was the first time since Continentals were issued to fund the Revolutionary War that the Federal Government had issued fiat currency. Like the prior issuance, this issuance would be used to fund a war.

The legality/constitutionality of the Act was litigated in the Supreme Court in 1871. Judge Salmon Chase, who was the Secretary of the Treasury (and a key supporter of the greenback issuance) when the idea of issuing greenbacks was concocted, wrote the majority opinion in favor of the issuance.

The Specie Payment Resumption Act of 1875 converted the greenbacks from unbacked, fiat currency to representative money by making greenbacks redeemable for gold.

5.1.7 The Coinage Act of 1873 (or Crime of ‘73)

The Coinage Act of 1873 prohibited the holders of silver bullion from having their silver minted into fully legal tender silver coins thus ending bimetallism and putting the U.S. solely on the gold standard. The Act effectively demonetized silver and reduced the money supply significantly as new legal tender coins could only be minted in gold.

The Coinage Act of 1873 is often referred to as the “Crime of 1873” because it had significant economic and political repercussions, especially for certain groups in the United States.

5.1.7.1 Demonetization of Silver

The Act effectively ended the minting of silver dollars, which led to the demonetization of silver. Prior to this, both gold and silver were used as legal tender under a bimetallic standard, meaning that currency could be backed by either metal. The Act changed the U.S. monetary standard to a de facto gold standard by omitting the silver dollar from the list of authorized coins.

5.1.7.2 Impact on Farmers and Debtors

The demonetization of silver reduced the money supply, which led to deflation (a decrease in the general price level of goods and services). For farmers and debtors who were often reliant on the value of their crops and had loans to repay, deflation made it harder to pay off debts because the value of money increased while their income remained the same or decreased. This economic squeeze led to widespread financial hardship among these groups.

5.1.7.3 “Cross of Gold” Speech

William Jennings Bryan’s most famous speech, the “Cross of Gold” speech delivered at the Democratic National Convention in 1896, passionately criticized the gold standard and called for the free coinage of silver. In this speech, Bryan argued that “you shall not crucify mankind upon a cross of gold,” expressing his belief that sticking strictly to the gold standard was harmful to the average American, particularly farmers and laborers, and only benefited the wealthy and banking interests. The speech electrified the convention and helped Bryan secure the Democratic nomination for president.

5.1.7.4 Cornering the Market on Gold

Having money backed by multiple commodities, such as gold and silver—or even better, a diversified basket of commodities—reduces the likelihood of any one commodity being monopolized. Following the Crime of ’73, the shift to relying solely on gold created the potential for gold traders to dominate the market, allowing them to manipulate the value of money and influence the availability of credit.

5.1.8 The Gold Standard Act of 1900

The Gold Standard Act was the final nail in the coffin of the silver dollar. The Act defined the dollar as 23.22 grains of fine gold (25 8/10 grains of nine-tenths purity) and reconfirmed the price/value of one ounce of gold as twenty dollars and 67 cents ($20.67).

5.1.9 The Federal Reserve Act (1913)

The Federal Reserve Act created a central banking system with authority given to the Board of Governors to manage the nation’s money supply and regulate banking at the local, state, and national level. Banks were previously chartered at the state level. (More about banking in the next unit.) The Act was passed on December 23, 1913–two days before Christmas–with many congressional representatives already out of town for the holiday and the remaining ones wanting to get out of town as quickly as possible so they could enjoy Christmas with their families.

Prior to the Federal Reserve Act, and as outlined in this Unit, the amount of money in the financial system (the money supply) was a function of mining (work). The money supply increased as new gold (and prior to 1873, silver) was discovered and mined. New money literally couldn’t be “made” unless work was done to make it. This inelastic money supply forced prudent economic behavior and financial discipline on individuals, families, businesses, and governments. It also limited politicians’ ability to respond to economic crises since they were constrained by the requirements associated with creating money–work. Problems couldn’t simply be papered over with fiat currency.

This all changed with the passage of the Federal Reserve Act. The Federal Reserve would be authorized to create an elastic money supply with dollars having a minimum 40% backing of gold instead of the previously mandated 100% backing. However, to have an elastic money supply, you also have to have elastic money and an elastic definition of the dollar too. Instead of using an inelastic/fixed definition of the dollar where $20.67 equals 1 ounce of gold, the definition of a dollar would fluctuate along with the money supply as shown in the table below.

By reducing the required amount of gold backing the dollar (representative money) from 100% to 40%, The Fed could make $51,675 ($20,670/40% or 40% of X = $20,670). That is an additional $31,005 that can be created without requiring any additional gold (or work). This allowed The Fed to inflate the money supply by 150% ($31,005/$20,670) which in turn would increase the price of gold from $20.67 ($20,670/1,000 oz gold) to $51.67 ($51,675/1,000 oz gold).

The expression of equality in 1900 (per the Gold Standard Act) was:

1 oz gold = $20.67

However, by increasing the money supply to $51,675, the price of gold also increased. Think about what would happen if the people holding all those dollars wanted to exchange their dollars (representative money) for gold (commodity money) at the rate of $20.67 per ounce of gold? (Remember, representative money is simply a claim on a commodity.) That means for every $20.67, The Fed would need 1 ounce of gold. So with $51,675 dollars in claims, that would require 2,500 ounces of gold ($51,675/$20.67 per ounce) but, unfortunately, The Fed only had 1,000 ounces of gold. Somebody would be left without their gold and that person was the person who was the last in line to redeem their claim. (This is always the cause of banking panics–too many paper claims on an insufficient amount of physical money.)

To maintain equality for each new dollar created, the new exchange rate (the price) must be $51.67 per ounce of gold ($51,675/1,000 oz).

The new exchange rate after the devaluation would be:

1 oz gold = $51.67

Or, alternatively, if you had $20.67, you could exchange it for 40% of 1 oz of gold.

The new exchange rate in dollar terms would be:

$20.67 = 0.40 oz gold

And just like in Rome when Caesar devalued the denarius, by devaluing the dollar, or changing the amount of gold backing each dollar, The Congress, by way of the Federal Reserve, caused inflation in the money supply which is always associated with, and followed by, increases in the prices of bread, circus tickets, lamb chops, and all the other goods and services in the economy. This inflationary period from 1920 – 1929 was known as the Roaring Twenties.

5.1.10 The Emergency Banking Act (1933)

The Federal Reserve System (The Fed) was created in response to consistent, recurring banking panics, including those in 1873, and 1893, and 1907. The Fed was supposed to smooth the inconsistent business cycle and prevent future panics. The exact opposite occurred. With money untethered from work, The Fed was given power to manage an elastic money supply–the ideal amount to be determined by economists and bankers and influenced by politicians and businesses. Unfortunately, having the power to do something doesn’t always equate to having the skill or ability required to do it effectively. And managing an elastic money supply proved to be quite a difficult task, as characterized by the roaring irrational exuberance of the 1920s (the inflating of the bubble) that was followed by the crushing vengeance of the Great Depression at the end of the decade (the popping of the bubble)

The Great Depression reached its nadir in 1933. Franklin D. Roosevelt (FDR) won the U.S. presidential election in 1932 and was tasked to lead the country out of depression. On March 4, 1933, FDR was inaugurated President of the United States. Two days later, on March 6th, he declared a four-day national bank closure that closed all banks until Congress could take action to resolve the banking crisis. Three days later, on March 9th, Congress passed the Emergency Banking Act that authorized The Fed to issue new currency to banks so that they could meet depositors’ withdrawal demands when reopened.

5.1.11 Executive Order 6102 (1933)

One month after enacting the Emergency Banking Act, on April 5th, FDR signed Executive Order 6102 which prohibited U.S. citizens from owning or possessing gold. Citizens were required to deliver all gold coins, gold bullion, and gold certificates to the Federal Reserve by May 1st or be punished by a fine up to $10,000 or imprisonment up to ten years, or both. In exchange for each ounce of gold confiscated by The Federal Reserve, citizens would be given $20.67 in Federal Reserve Notes. See “Roosevelt’s Gold Program” at https://www.federalreservehistory.org/essays/roosevelts_gold_program.

5.1.12 Gold Reserve Act (1934)

The Gold Reserve Act transferred gold from the Federal Reserve—previously confiscated from U.S. citizens—to the U.S. Treasury. It also raised the price of gold from $20.67 to $35 per ounce, a 40% increase. Americans who were forced to sell their gold the prior year at the lower price likely felt cheated, while foreign holders and gold miners benefited from the sudden rise. As a result, gold poured into U.S. reserves.

Devaluing Money:

Devaluing hard commodity money involves reducing the precious metal content in coins, as Caesar did with the Roman denarius. Devaluing representative money is even easier—you simply change its price, as Roosevelt did by revaluing gold.

Money for Nothing:

By revaluing gold, Roosevelt effectively created 40% more money without producing more goods, raising taxes, or requiring additional labor. With one stroke of the pen, the government’s gold reserves increased in value, demonstrating how rulers have historically sought ways to generate money without work or taxation—a timeless strategy for funding political agendas.

5.1.13 World War II and The Bretton Woods Agreement (1944)

Ten years later, Europe, Japan, and parts of Russia were decimated by fighting in World War II. The U.S. was largely unscathed with the exception of Pearl Harbor, HI. Being flush with gold and not having the expense associated with post-war rebuilding of infrastructure, the U.S. was poised to dethrone the British and their pound sterling as the world’s reserve currency.

At the end of WWII, the leaders of the victorious nations met at a ski resort in Bretton Woods, NH to hammer out the post-war global financial system. The new system would be dollar-centric with each nation’s domestic currency tied to the dollar at a fixed, but flexible, exchange rate and the dollar tied to gold at $35/oz. The dollar would be “as good as gold”.

5.1.14 Bread, Circus, and War (1960’s)

The 50’s and 60’s saw the Korean War and the Vietnam War plus tons of deficit spending on Lyndon Johnson’s “Great Society” social programs.

With profligate spending on bread (social programs) and war, foreign governments became more and more concerned about the management of the dollar–to which their currencies were tied. Fearing that the U.S. government was mismanaging the dollar, they sought to exchange their dollar holdings for gold.

5.1.15 Nixon Shock (August 15, 1971)

Less than 30 years after the Bretton Woods Monetary Agreement, U.S. President Richard Nixon shocked the world by terminating the convertibility of dollars to gold. The Nixon Shock did to foreigners what FDR’s Executive Order 6102 did to U.S. citizens–prevented them from escaping the devaluation of the dollar by canceling the convertibility of the dollar to gold.

From this day in August of 1971 to today, all major national currencies are fiat currencies.

5.1.16 Petrodollar (1974 – Present (2015))

After the Nixon Shock severed the dollar’s link to gold, U.S. inflation soared in the 1970s. To stabilize the dollar’s value, President Nixon sent Secretary of State Henry Kissinger to negotiate a deal with Saudi Arabia. In exchange for U.S. military protection, the Saudis agreed to sell oil exclusively in U.S. dollars.

This arrangement effectively tied the dollar to black gold (oil), giving it quasi-commodity backing. As the international reserve currency, global demand for dollars remained strong, keeping interest rates low.

While no longer backed by gold, the dollar’s dominance persisted because oil-powered economies depended on dollars for energy—the foundation of modern industrial life. In a fiat world, the petrodollar system gave the U.S. dollar an enduring edge.

5.1.17 The Birth of Bitcoin (January 2009)

In the midst of The Great Recession, Bitcoin was born. The genesis block was mined on Saturday, January 3, 2009. The text associated with the block read: The Times 03/Jan/2009 Chancellor on brink of second bailout for banks. The text was a reference to the headline (Chancellor on brink of second bailout for banks) of The Times (the British Daily Newspaper) on 3 January 2009.

The pseudonymous Satoshi Nakamoto is the father of Bitcoin. He authored the paper, “Bitcoin: A Peer-to-Peer Electronic Cash System” that was posted on Bitcoin.org on October 31, 2008. The identity of the real Satoshi remains unknown.

5.2 Devaluing Money—A Historical Perspective

Throughout history, leaders and politicians have used devaluation of money as a tool to achieve political objectives, such as funding wars, expanding public programs, or maintaining power. Devaluation allows governments to inflate the money supply without raising taxes or producing additional goods or resources, effectively enabling them to finance their goals at the expense of savers and wage earners.

5.2.1 Devaluing Commodity Money

Commodity money, such as gold or silver coins, derives its value directly from the material it contains. Devaluing commodity money involves reducing the amount of precious metal in the coin while maintaining its face value. This process is often referred to as coin clipping or debasement.

Example – Ancient Rome:

Caesar and the Denarius: Roman emperors debased silver coins by reducing silver content and replacing it with base metals (like copper).

Over time, a denarius that once contained 90% silver fell to less than 5% silver, resulting in inflation as more coins were needed to buy the same goods.

The Roman government used this strategy to fund wars, pay soldiers, and appease citizens with “bread and circuses” without raising taxes.

Key Point: Devaluing commodity money requires physical changes—altering the amount or purity of the commodity in each unit.

5.2.2 Devaluing Representative Money

Representative money, like gold-backed paper currency, is a claim on a fixed quantity of a commodity (e.g., gold or silver). Devaluing representative money doesn’t require changing the paper itself—only the amount of commodity it represents.

Example – Roosevelt and the Gold Reserve Act (1934):

Before 1934: $20.67 = 1 oz of gold

After 1934: $35.00 = 1 oz of gold

Result: The dollar lost 40% of its value overnight, inflating the money supply and driving up prices without any additional work or resources being produced.

This allowed the government to fund New Deal programs, avoid raising taxes, and finance public spending to combat the Great Depression.

Key Point: Devaluing representative money involves changing the official exchange rate between the currency and the commodity it represents, effectively inflating the money supply and decreasing purchasing power.

5.2.3 Devaluing Fiat Currency

The most audacious devaluation in monetary history occurred when the United States broke the Bretton Woods Agreement in 1971, completely severing the dollar’s link to gold and transforming it into fiat currency—devoid of any commodity backing.

The Bretton Woods Agreement (1944–1971):

- Established a gold-backed monetary system after World War II.

- The U.S. dollar was tied to gold at $35 per ounce, and other currencies pegged their value to the dollar.

- Foreign governments could redeem dollars for gold, ensuring global monetary stability.

The Nixon Shock (1971):

- Facing trade deficits, debt-financed spending, and dwindling gold reserves, President Richard Nixon closed the gold window—ending the dollar’s convertibility into gold.

- This effectively transformed the dollar into fiat currency, backed only by faith in the U.S. government rather than physical commodities.

Impact:

- 100% Devaluation:

- The dollar instantly lost all commodity backing, rendering it a purely debt-based currency controlled by the Federal Reserve.

- Inflationary Consequences:

- Without gold constraints, the money supply expanded rapidly, leading to inflation and the erosion of purchasing power.

- Example: 1970s Stagflation—high inflation and unemployment combined with stagnant economic growth.

- Debt-Driven Economy:

- Governments gained the ability to spend without limits, funding wars (Vietnam) and social programs without raising taxes or increasing production.

- Global Monetary Instability:

The collapse of Bretton Woods forced countries to adopt floating exchange rates, introducing currency volatility and competitive devaluations.

5.2.3 Devaluation as a Political Tool

Devaluing money has long been a tool for leaders and governments to achieve political objectives:

Financing Wars: Rome debased coins to fund military conquests. Modern governments inflate the money supply to finance wars without public approval of higher taxes.

Social Programs and Welfare: Roosevelt’s devaluation funded New Deal programs, while modern governments use inflation to sustain welfare states.

Economic Stimulus: Politicians expand the money supply to stimulate economic growth and reduce unemployment, often at the cost of future inflation.

Bread and Circuses: Leaders have historically used cheap money to provide public entertainment and food subsidies, maintaining political stability and social order.

Key Takeaway:

Commodity money is devalued by reducing its precious metal content.

Representative money is devalued by changing its exchange rate with the commodity backing it.

Devaluation serves political purposes by financing wars, public programs, and economic expansion without requiring additional work or higher taxes.

However, inflation caused by devaluation erodes purchasing power, harms savers, and undermines long-term economic stability.

Conclusion:

The history of money reflects humanity’s evolving attempts to balance trust, value storage, and medium of exchange. From barter and commodity money to representative and fiat currencies—and now cryptocurrencies—each stage of this evolution addressed specific challenges but introduced new vulnerabilities and trade-offs.

Commodity money, such as gold and silver, provided intrinsic value and stability but lacked portability and scalability. Representative money allowed greater flexibility while maintaining commodity backing, yet it proved susceptible to devaluation. Fiat currency, untethered from physical commodities, provided governments with unprecedented control over monetary policy but also led to inflation, debt cycles, and monetary manipulation. Today, cryptocurrencies and blockchain-based technologies offer decentralized alternatives, mimicking commodity scarcity while bypassing centralized authority.

A recurring theme in monetary history is the deliberate devaluation of money to meet political and economic objectives. From Caesar’s debasement of the Roman denarius to Roosevelt’s devaluation of gold-backed dollars, leaders have repeatedly altered the value of money to finance wars, economic expansions, and social programs—often at the expense of long-term economic stability. This pattern highlights the close relationship between money and power.

Key Takeaway:

The evolution of money—from barter to blockchain—demonstrates an ongoing tension between stability and flexibility, freedom and control, trust and manipulation. While modern monetary systems have enabled global trade and growth, they have also created inequality, debt dependency, and inflationary cycles. Recognizing the political motivations behind monetary devaluation equips us to better analyze present challenges and prepare for future transformations.