Lesson 7 - The Supply of Money, Currency, and Cryptocurrency

Learning Objective: Understand and be able to explain who controls the supply of money, currency, and cryptocurrency, and how they exercise that control.

7.1 The Supply of Money, Currency, and Cryptocurrency

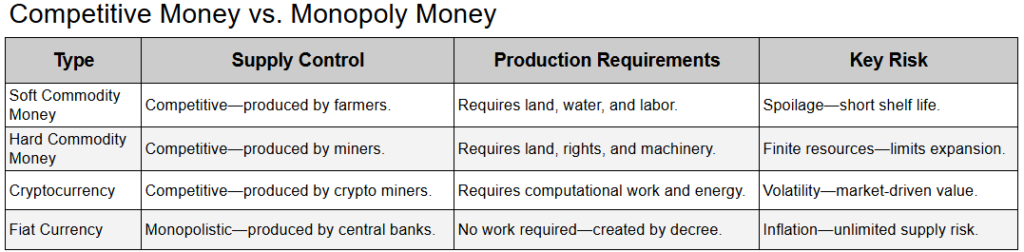

The supply of money depends on its type and method of production:

- Soft Commodity Money – Supplied by farmers through agricultural production.

- Hard Commodity Money – Supplied by miners who extract precious metals.

- Cryptocurrency – Supplied by crypto miners who validate transactions using computational work.

- Fiat Currency – Supplied exclusively by central banks through monetary policy tools like reserve requirements, open market operations, and interest rates—enforcing a government monopoly on its creation.

7.1.1 The Supply of Soft Commodity Money

- Examples: Grains such as wheat, barley, and corn.

- Supply Constraints: Dependent on natural conditions, seasons, and land availability.

Key Limitation: Subject to spoilage, unlike hard commodities.

Competition: Anyone with land, water, and seeds can compete based on their ability to grow, harvest, and distribute crops efficiently—driving innovation and productivity.

7.1.2 The Supply of Hard Commodity Money

- Gold: Approximately 244,000 metric tons discovered globally (finite supply).

- Silver: Roughly 1.74 million metric tons discovered (finite supply).

Key Feature: Scarcity enforces long-term stability and value preservation.

Competition: Anyone with land and mineral rights can participate in mining, ensuring a decentralized and competitive supply by driving innovation and productivity.

7.1.3 The Supply of Cryptocurrency (Bitcoin)

- Finite Supply: Bitcoin has a hard cap of 21 million coins.

- Current Supply: ~19 million bitcoins mined as of 2023.

- Production Method: Proof-of-work mining requires computational energy, mimicking the effort required to mine gold.

Key Features:- Scarcity and decentralized control enforce deflationary tendencies over time.

- Competition: Anyone with a computer and internet access can become a crypto miner, ensuring competition and distributed security.

7.1.4 The Supply of Fiat Currency

- Unlimited Supply: Fiat currency is not constrained by scarcity or production costs.

- Monetary Expansion Tools:

- Reserve Requirements: Reduced to 0% in March 2020, allowing banks to create unlimited credit.

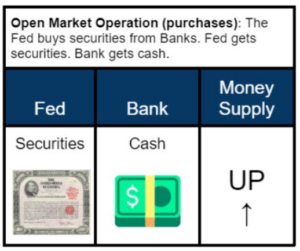

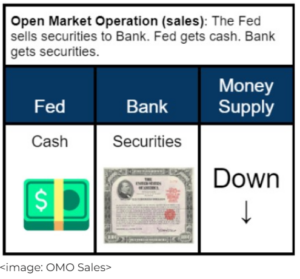

- Open Market Operations (OMOs): Central banks buy or sell government bonds to control liquidity.

- Interest Rates: Used to influence borrowing costs and manipulate economic activity.

- Supply Statistics:

- M1 Money Supply (2023): ~$16 trillion.

- M2 Money Supply (2023): ~$21.7 trillion.

Monopoly Control:

- Competition: Only central banks can issue fiat currency, making them the sole supplier and enforcer of the monetary system. Anyone attempting to compete by issuing private fiat currencies will face criminal prosecution for counterfeiting.

7.1.5 Competitive Money vs. Monopoly Money

Competitive, Free-Market Money:

- Commodity Money (soft and hard) and cryptocurrency rely on competition for production:

- Farmers compete to produce soft commodities using land, water, and labor.

- Miners compete to extract hard commodities, requiring access to land, mineral rights, and energy.

- Crypto miners compete to validate transactions and secure networks through computational work.

- Competition enforces discipline because producers must invest work, time, and resources to supply money.

- Commodity Money (soft and hard) and cryptocurrency rely on competition for production:

Monopoly Money (Fiat Currency):

- Government Central Banks have a state-enforced monopoly on the creation and supply of fiat currency.

- Unlike free-market money, fiat currency requires no work or resources to produce—only the decision of central planners.

- Private citizens cannot compete with central banks; anyone attempting to issue fiat currency is prosecuted for counterfeiting.

Economic Consequences:

- Commodity Money and Cryptocurrency: Scarcity and competition create accountability, preserving value over time.

- Fiat Currency: Monopoly control allows for unlimited supply, enabling governments to inflate or devalue currency at will—often benefiting elites while harming savers and workers.

7.3 The Federal Reserve and the Fiat Currency Supply

The Federal Reserve uses three tools to control fiat currency supply:

7.3.1 Reserve Requirements

- Current Rate: 0% (as of March 2020).

- Enables banks to create unlimited fiat currency through loans.

7.3.2 Open Market Operations (OMO)

7.3.3 Interest Rates

- Interest rates determine the price of borrowing money.

- Low Rates (ZIRP): Encourage borrowing and inflation.

- High Rates: Reduce lending and curb inflation.

Example: From 2009–2015, the Fed implemented a Zero-Interest-Rate Policy (ZIRP), flooding the market with cheap money.

7.4 Inflation and Price Changes

Two Definitions of Inflation

Classical Definition – Inflation is an increase in the money supply and credit relative to goods and services.

- Cause-Focused: Emphasizes the expansion of money supply as the root cause.

- Symptom: Rising prices are seen as the result of monetary inflation.

- Accountability: Highlights the role of central banks and governments in driving inflation through excessive money printing and credit creation.

Modern Definition – Inflation is the general increase in prices over time, resulting in a decline in the purchasing power of money.

- Effect-Focused: Tracks price changes in consumer goods and services using indices like CPI and PCE.

- Obfuscation of Cause: Shifts attention away from monetary policy to external factors such as supply chains, wages, or corporate pricing strategies.

Why the Shift in Definitions?

Governments and central banks moved away from the classical definition to the modern definition for strategic reasons:

- Deflecting Responsibility: By defining inflation as rising prices, governments can blame corporations for being “greedy” or “price gouging,” while obscuring the role of monetary policy in driving inflation.

- Political Narrative: Rising prices can be attributed to external crises (e.g., supply chain disruptions, labor shortages) or market behaviors, shifting blame from policymakers to businesses.

- Underreporting Inflation: Tools like CPI are designed to track price changes but can be manipulated to downplay inflation’s true impact through substitution bias, hedonic adjustments, and exclusion of housing prices.

- Public Perception: The modern definition aligns with what people feel—higher grocery bills and gas prices—while leaving the root cause of inflation hidden behind complex monetary mechanics.

7.4.1 How Is Inflation Measured?

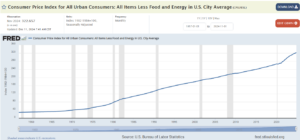

1. Consumer Price Index (CPI):

Measures the average change over time in prices paid by urban consumers for a market basket of goods and services.

Categories Measured:

- Food and Beverages: Groceries, dining out.

- Housing: Rent, utilities.

- Transportation: Gasoline, vehicles.

- Healthcare: Medical services, prescriptions.

- Education and Recreation: Tuition, entertainment.

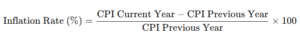

Formula:

Source: U.S. Bureau of Labor Statistics (BLS)

CPI Measurement (2024):

https://fred.stlouisfed.org/series/CPILFESL

2. Producer Price Index (PPI):

Measures price changes from the producer’s perspective—tracks costs of raw materials, intermediate goods, and finished products.

- Often a leading indicator of future consumer inflation as producers pass higher costs to consumers.

3. Personal Consumption Expenditures (PCE):

The Federal Reserve’s preferred metric because it adjusts for consumer substitution (e.g., switching to cheaper products when prices rise).

- Reflects actual spending patterns more accurately than CPI.

7.4.2 Core Inflation vs. Headline Inflation

- Headline Inflation: Includes all CPI categories, including volatile food and energy prices.

- Core Inflation: Excludes food and energy to focus on underlying trends.

Example:

A temporary spike in gasoline prices raises headline inflation, while core inflation may remain stable, reflecting long-term trends better.

7.4.3 Limitations of Inflation Metrics

- Substitution Bias:

- Assumes consumers switch to cheaper alternatives, understating the real impact of inflation.

- Hedonic Adjustments:

- Hedonic adjustments aim to account for improvements in product quality when measuring inflation. For example, if a new iPhone model is released at the same price as the previous model but includes better features—such as a faster processor or improved camera—these enhancements are treated as a price reduction, even if the actual price remains unchanged or increases slightly. This adjustment suggests that consumers are getting more value for their money, effectively lowering the measured inflation rate.

- Exclusion of Housing Prices:

- CPI uses rent equivalents instead of actual home prices, failing to capture housing inflation accurately.

- Geographic Differences:

- CPI reflects urban prices, ignoring rural areas where inflation might differ.

- Substitution Bias:

7.4.4 Alternative Measures of Inflation

- ShadowStats (Shadow Government Statistics):

- Recalculates inflation using pre-1980s methodologies.

- Often reports higher inflation rates than official CPI.

- Chained CPI:

- Adjusts for consumer behavior changes, like switching to cheaper goods.

- Critics argue it downplays inflation, reducing cost-of-living adjustments.

- ShadowStats (Shadow Government Statistics):

7.4.5 Real-World Impacts of Inflation

Hidden Tax on Savings:

- Savings lose value over time due to inflation.

- Example: A 1% interest savings account loses purchasing power if inflation is 6%.

Blame Shifting:

- Governments often blame businesses for rising prices, portraying corporations as “greedy” or “price-gouging.”

- Reality Check: Rising prices are often a direct consequence of monetary expansion, with businesses merely adjusting to higher input costs or maintaining margins.

Wages and Cost of Living Adjustments (COLA):

- Social Security, pensions, and wages are adjusted using CPI.

- Understated CPI reduces real income for retirees and workers.

Wealth Redistribution:

- Inflation disproportionately impacts low-income households who spend more on necessities like food and housing.

- Asset holders benefit as inflation drives up prices for stocks and real estate.

Weaponizing Inflation Metrics:

- Misrepresenting inflation through flawed metrics enables governments to justify poor policies, like excessive money printing or delayed interest rate hikes.

Key Takeaways

- Two Perspectives:

- Classical View: Inflation begins with monetary expansion, leading to price increases.

- Modern View: Inflation is measured through rising prices but often ignores monetary origins.

- Government Manipulation:

- By focusing on prices rather than money supply, governments evade accountability and shift blame to businesses.

- Economic Consequences:

- Misdiagnosing inflation risks poor policy decisions, exacerbating inequality and economic instability.

- Transparency and Trust:

- Understanding the root causes of inflation is critical for holding policymakers accountable and protecting savings from erosion.

- Two Perspectives:

7.5 Deflation

Deflation is a contraction in the money supply or credit, leading to:

- Falling prices for goods and services.

- Increased purchasing power of money.

- Rising debt burdens as loans become harder to repay.

7.5.1 Causes of Deflation

- Monetary Contraction:

- Central banks reduce the money supply or lending slows.

- Debt Defaults or Bank Failures:

- Collapsing banks reduce deposits and credit, shrinking available money.

- Productivity Gains:

- Efficiency or technology lowers production costs, reducing prices naturally.

- Demand Shock:

- Economic downturns reduce consumer and business spending.

- Monetary Contraction:

7.5.2 Productive vs. Destructive Deflation

Productive Deflation:

- Caused by technological advancements and efficiency gains.

- Leads to lower prices without hurting wages or growth.

- Example: Cheaper electronics due to innovation.

Destructive Deflation:

- Caused by monetary contraction or falling demand.

- Leads to unemployment, falling wages, and defaults.

- Example: The Great Depression (1930s) and Japan’s Lost Decades (1990s–2020).

7.5.3 Deflation’s Risks – The Debt Deflation Spiral

- Debt Becomes Heavier:

- Prices and wages fall, but debts remain fixed, making repayment harder.

- Delayed Spending:

- Consumers expect lower prices in the future, reducing current spending.

- Bank Failures:

- Loan defaults shrink bank reserves, causing a credit crunch.

- Asset Price Collapses:

- Housing and stock markets fall, wiping out wealth and confidence.

- Debt Becomes Heavier:

7.5.4 Tools to Fight Deflation

- Lowering Interest Rates:

- Encourages borrowing and spending.

- Limitation: At 0% interest rates, this tool fails (liquidity trap).

- Quantitative Easing (QE):

- Central banks create money to inject liquidity and stimulate the economy.

- Government Stimulus:

- Direct spending programs boost demand and credit.

- Lowering Interest Rates:

Key Takeaways:

- Deflation increases purchasing power but can worsen debt burdens and trigger recessions.

- Productive deflation results from efficiency, while destructive deflation stems from credit contractions and defaults.

- Modern monetary policies focus heavily on inflation to avoid deflationary collapse, creating debt bubbles in the process.

7.6 Purchasing Power of Fiat Currency

Money is intended to serve as a store of value, preserving purchasing power over time. However, fiat currency has consistently failed to fulfill this function due to inflation and monetary expansion.

Key Concept: Purchasing Power

- Definition: The purchasing power of a currency refers to the quantity of goods and services that can be bought with one unit of that currency.

- Insight: As inflation rises, the same amount of currency buys fewer goods and services, effectively reducing its purchasing power.

Historical Decline of the U.S. Dollar’s Purchasing Power

The chart below (from FRED) illustrates the purchasing power of the U.S. dollar from 1913 to 2024.

https://fred.stlouisfed.org/series/CUUR0000SA0R

- 1913: The Federal Reserve was established. A dollar held significantly more purchasing power.

- 1933: Gold backing was suspended, and the dollar’s value began to decline sharply.

- 1971: The U.S. fully abandoned the gold standard under President Nixon (the “Nixon Shock”). Fiat currency replaced representative money, accelerating the decline.

- 2024: The purchasing power of the dollar has fallen to 31.7 (relative to 1982-1984 values)—losing more than 96% of its value since the creation of the Federal Reserve.

Key Observations:

- Long-Term Decline: The dollar’s purchasing power has steadily decreased due to inflation caused by monetary expansion.

- Inflationary Pressures: Major events like wars, economic crises, and stimulus programs fueled rapid declines in purchasing power.

- Modern Trends: The 2020-2021 COVID-19 stimulus packages and monetary easing quadrupled the money supply, leading to a renewed wave of inflation.

Practical Implications:

- Savings Are Eroded: Holding cash over time leads to a loss of value, incentivizing speculative investments instead of saving.

- Wages Lag Behind Prices: Workers often face declining real wages as prices rise faster than incomes.

- Wealth Transfers: Inflation acts as a hidden tax, transferring wealth from savers and wage earners to borrowers and asset holders.

- Systemic Risks: Excessive reliance on fiat currency risks hyperinflation and societal instability, as seen in historical cases like Weimar Germany and Zimbabwe.

Key Reflection:

If fiat currency has lost over 96% of its value in just over 100 years, what mechanisms—beyond trust—can sustain its long-term credibility? How can individuals protect their savings and purchasing power in an inflationary system?

7.7 Free Market Money

- Free Market Money: Supplied by market participants (producers) and regulated by competition.

- Centrally Planned Currency: Controlled by central planners with no competition, risking inflation and economic instability.

Conclusion:

The supply of money reveals the contrast between systems grounded in work and scarcity versus systems based on decree and trust.

- Commodity Money—stable, work-based, and constrained by scarcity—preserves value.

- Fiat Currency—unconstrained and centrally managed—enables economic expansion but invites inflation and systemic risks.

- Cryptocurrency—scarce, decentralized, and digital—challenges traditional systems but faces hurdles in adoption and stability.

Key Takeaway:

Who controls the money supply determines its stability, fairness, and economic impact. History shows that systems grounded in work and scarcity promote stability, while systems relying on central planning often lead to inflation, inequality, and collapse.

Key Reflection:

Should money be controlled by producers through work and competition—or planners through decree and trust?